US Dollar cuts losses, back near 101.00

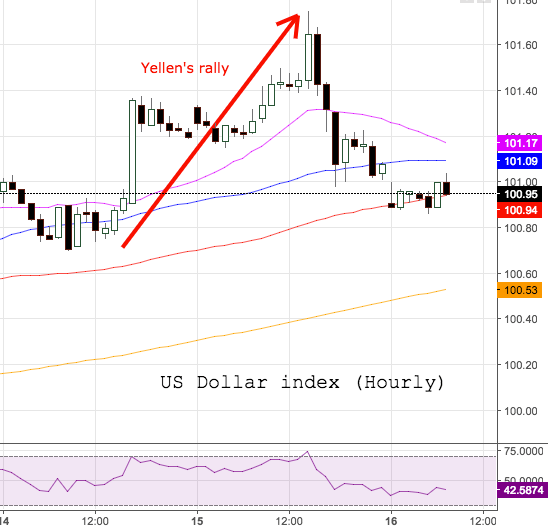

The US Dollar Index – which gauges the buck vs. its main competitors - has partially reverted the initial dip and is now attempting to regain the 101.00 handle.

US Dollar Index focus on data

The index lost upside momentum during the second testimony by Chair Yellen before the House Financial Services Committee on Wednesday, fading the advance to fresh 5-week tops near 101.80 and probing the 100.90/85 band during overnight trade.

USD eased some ground despite the hawkish view from Chief Yellen and recent supportive comments by FOMC governors, all reinforced by higher-than-expected results from US CPI and Retail Sales during January.

Yields in US money markets have deflated from recent highs, reflecting the softer tone in the buck, although rising expectations of a rate hike at the March meeting continue to support USD and limit the downside somewhat.

In the data space, Housing Starts, Building Permits and the Philly Fed manufacturing index are all due later in the NA session.

US Dollar relevant levels

The index is losing 0.10% at 100.98 facing the next support at 100.79 (38.2% Fibo of the November-January up move) followed by 100.37 (20-day sma) and then 100.03 (low Feb.8). On the other hand, a breakout of 101.75 (high Feb.15) would target 101.95 (23.6% Fibo of the November-January up move) en route to 102.96 (high Jan.11).