EUR/USD edges lower below 1.06 on USD strength

The EUR/USD is extending losses on Friday during the NA session, as the US Dollar Index is making another attempt towards the critical 101 level. At the moment, the pair is down 0.42% at 1.0599 while the DXY is up 0.42% at 101.02.

The major equity indexes in the United States gathered strength after having a slow start to the day. Moreover, the yield on the benchmark 10-year U.S. Treasur

Markets quickly digested the lower than expected payroll growth in the United States (98K vs. 180K exp.) as the bad weather in March is considered to have an adverse impact on the hiring. Most experts see that as a temporary situation and expect the April numbers to rebound strongly. “Market participants should look past a disappointing March report,” Deutsche Bank analysts including chief U.S. economist Joe LaVorgna told Bloomberg news and added that a strong snapback in jobs and hours should be expected in the April data.

- Dollar resilient after weak jobs data - BBH

On a separate note, New York Fed President William Dudley said that the rates would continue to be the primary policy tool and not slow balance sheet reduction.

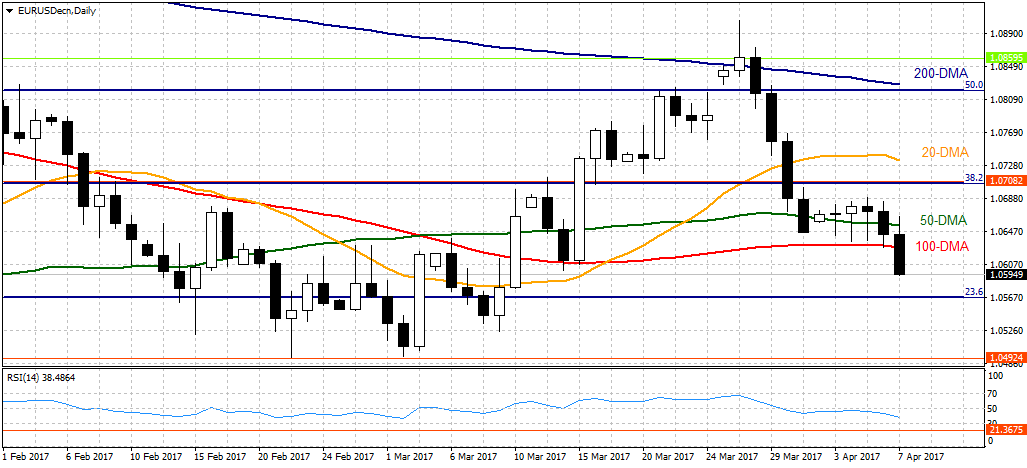

Technical outlook

The immediate support for the pair aligns at 1.0525 (Mar. 9 low) before 1.0455 (Jan. 11 low) and 1.0390 (Jan. 4 low). On the upside, a break above the 100-DMA at 1.0630 could open the door to 1.0700 (psychological level) and 1.0735 (20-DMA).