EUR/USD - Risk Reversal points to bull trap

Following two consecutive Doji like candles with long lower shadows, the EUR/USD pair rallied to a high of 1.1848 on Friday. The gains were fuelled by a weaker-than-expected US inflation release and the resulting drop in the Fed rate hike odds.

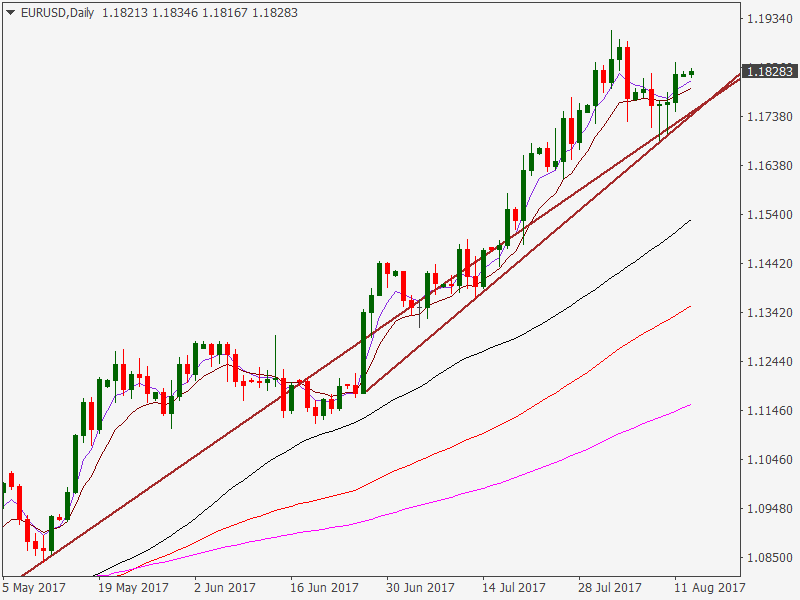

Daily chart

Friday’s rally marks a sharp rebound from the rising trend line support. The technical pattern is encouraging for bulls, however, options market calls for caution.

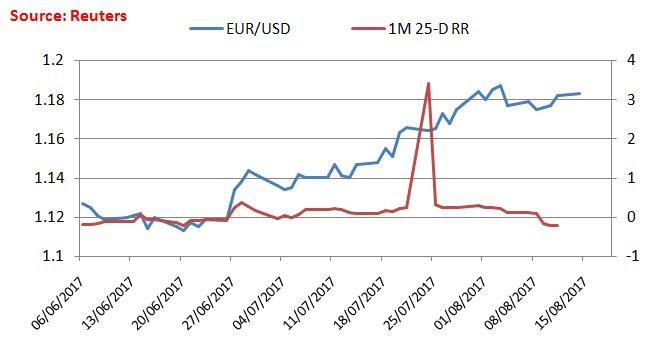

One-month 25-delta risk reversal

- The one-month 25-delta risk reversal has dipped into the negative territory over the last few days despite the rebound in the EUR/USD from the trend line support.

- It indicates, the demand for Put options or downside bets has strengthened.

- Hence, caution is advised as Friday’s gains could end up being a bull trap.

EUR/USD Technical Levels

The spot traded largely flat lined in Asia around 1.1830 levels. A break above 1.1848 [previous day’s high] would open doors for 1.1910 [recent high], above which a major hurdle is seen at 1.20 [psychological level].

On the downside, breach of support at 1.1799 [1-hour 200-MA] could yield a re-test of 1-hour 50-MA located at 1.1774 and 1-hour 100-MA located at 1.1769.