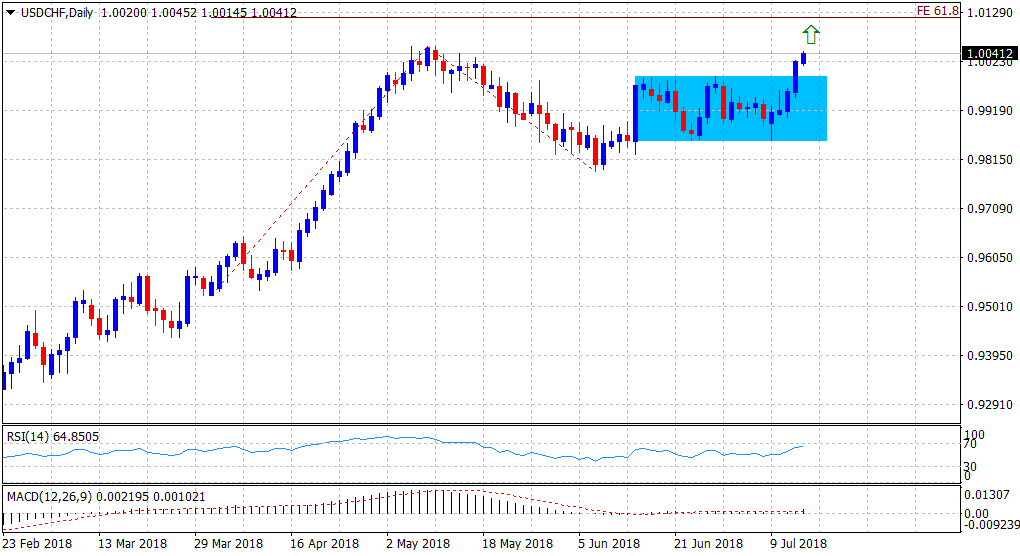

USD/CHF Technical Analysis: Move towards YTD tops, and beyond, now looks a distinct possibility

• The pair built on the overnight bullish breakthrough one-month-old trading range, with persistent USD buying interest providing an additional boost on Friday.

• Short-term technical indicators are gradually picking up the pace and remain supportive of an extension of the ongoing positive momentum.

• Bulls might now be looking to test YTD tops, set in May, before eventually aiming to test 61.8% Fibonacci expansion level of the April-May upswing and subsequent retracement.

USD/CHF daily chart

Spot rate: 1.0041

Daily Low: 1.0015

Trend: Bullish

Resistance

R1: 1.0057 (YTD tops set on May 10)

R2: 1.0082 (R2 daily pivot-point)

R3: 1.0117 (61.8% Fibo. expansion)

Support

S1: 1.0015 (current day swing low)

S2: 0.9990 (trading range resistance break-point)

S3: 0.9970 (S1 daily pivot-point)