Back

19 Sep 2018

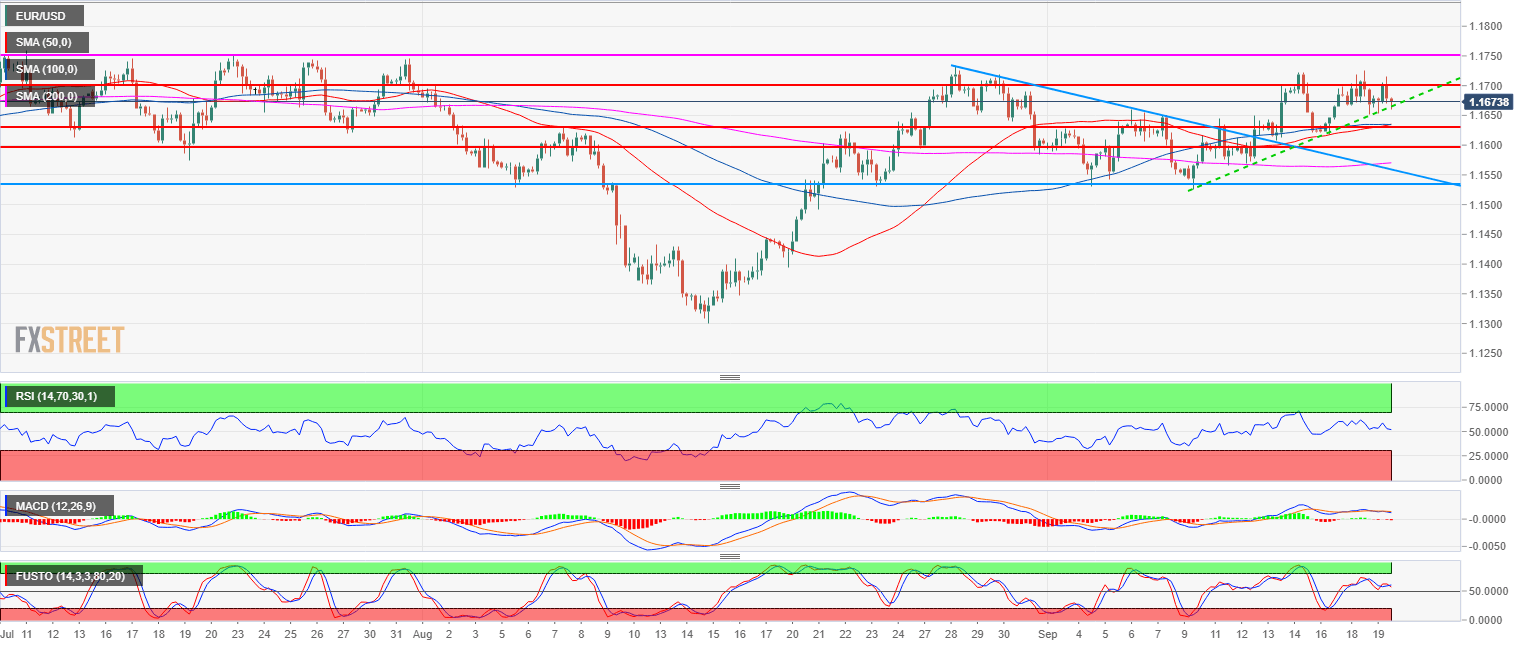

EUR/USD Technical Analysis: EUR/USD supported above 1.1650 ahead of Draghi’s speech

- EUR/USD main bear trend is on hold since mid-August.

- EUR/USD is consolidating the breakout from the triangle pattern (blue lines) above the (green) bull trendline and the 50 and 100-period simple moving averages.

- The currency pair remains bullish ahead of Mario Draghi’s speech, President of the European Central Bank, scheduled at 13:00 GMT. The event can lead to lots of volatility in the forex market and especially on the Euro currency.

- Main supports are seen near 1.1600-1.1630 while targets to the upside are the 1.1750 key resistance level followed by 1.1800 figure. A break below 1.1530 would likely invalidate the bullish bias

EUR/USD 4-hour chart

Spot rate: 1.1672

Relative change: 0.06%

High: 1.1715

Low: 1.1653

Main trend: Bearish

Short-term trend: Bullish above 1.1530

Resistance 1: 1.1722 last week high

Resistance 2: 1.1750 key resistance (July)

Resistance 3: 1.1800 figure

Resistance 4: 1.1853 June 14 high

Support 1: 1.1654 August 27 high

Support 2: 1.1630 August 8 high key level

Support 3: 1.1600 figure

Support 4: 1.1572 July 19 low

Support 5: 1.1542 supply/demand level

Support 6: 1.1530 August 23 swing low

Support 7: 1.1508 June 8 low