Back

20 Feb 2019

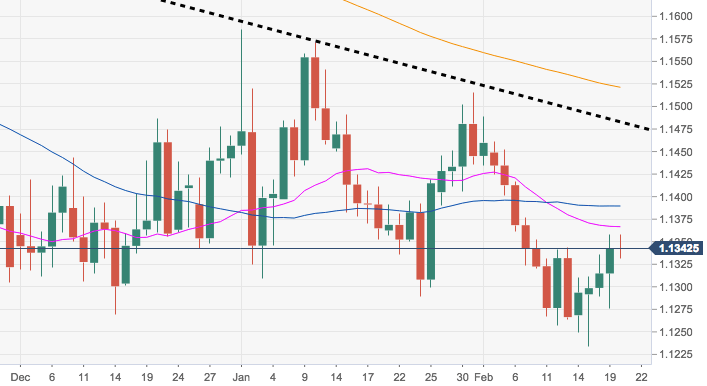

EUR/USD Technical Analysis: Spot erodes the Fibo retracement in the mid-1.1300s

- EUR/USD keeps trading on a positive note so far this week and is now challenging the 1.1350/55 band, where emerges a Fibo retracement of the September-November drop.

- The pair needs to regain the 100-day SMA in the 1.1400 neighbourhood in order to alleviate downside pressure, although the bearish view is poised to persist while below the short-term resistance line at 1.1482.

- In case the offered bias resumes, the 10-day SMA at 1.1309 emerges as the initial support ahead of YTD lows in the 1.1235/30 band.

EUR/USD daily chart

EUR/USD

Overview:

Today Last Price: 1.1344

Today Daily change: 24 pips

Today Daily change %: 0.01%

Today Daily Open: 1.1343

Trends:

Daily SMA20: 1.1368

Daily SMA50: 1.1392

Daily SMA100: 1.14

Daily SMA200: 1.1524

Levels:

Previous Daily High: 1.1358

Previous Daily Low: 1.1276

Previous Weekly High: 1.1344

Previous Weekly Low: 1.1234

Previous Monthly High: 1.1586

Previous Monthly Low: 1.1289

Daily Fibonacci 38.2%: 1.1327

Daily Fibonacci 61.8%: 1.1307

Daily Pivot Point S1: 1.1293

Daily Pivot Point S2: 1.1243

Daily Pivot Point S3: 1.121

Daily Pivot Point R1: 1.1376

Daily Pivot Point R2: 1.1409

Daily Pivot Point R3: 1.1459