When is Canadian CPI and how could it affect USD/CAD?

Canadian CPI Overview

Wednesday's economic docket highlights the release of Canadian consumer inflation figures for the month of January, scheduled to be published at 13:30 GMT. The headline CPI is anticipated to have ticked higher 0.% m/m and the yearly rate is anticipated to have decelerated to 1.5% in the reported month.

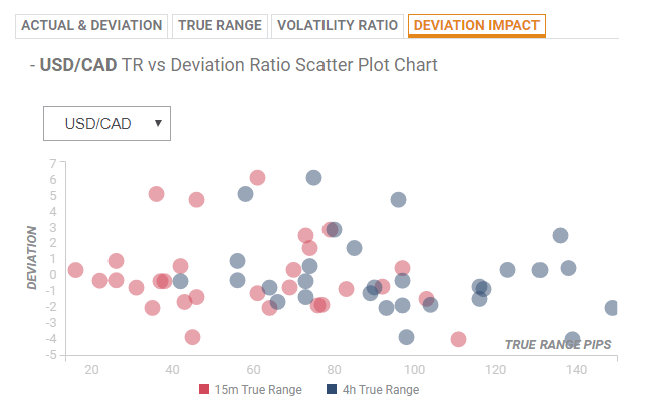

Deviation impact on USD/CAD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction on the pair is likely to be around 26-pips during the first 15-minutes and could get extended to 45-pips in the following 4-hours in case of a relative deviation of -1.02.

How could it affect USD/CAD?

Ahead of the important release, the pair was seen holding weaker around the 1.3135-30 region and a follow-through selling, led by any positive surprise from the inflation figures, might turn the pair vulnerable to break through the 1.3100 handle and slide further towards testing monthly swing lows, around the 1.3070-65 region.

Alternatively, a weaker reading might exert some downward pressure on the Canadian Dollar and prompt a short-covering bounce towards the 1.3185 horizontal resistance. The momentum could further inspire bulls to retake the 1.3200 handle and aim towards challenging 10-day SMA, around mid-1.3200s.

Key Notes

• USD/CAD falls to session lows amid surging oil prices, Canadian CPI in focus

• Market themes of the Day: Powell's testimony 2.0 and Canada's core inflation headline

About BoC's Core CPI

Consumer Price Index Core is released by the Bank of Canada. “Core” CPI excludes fruits, vegetables, gasoline, fuel oil, natural gas, mortgage interest, intercity transportation, and tobacco products. These volatile core 8 are considered as the key indicator for inflation in Canada. Generally speaking, a high reading anticipates a hawkish attitude by the BoC, and that is said to be positive (or bullish) for the CAD.