Back

12 Jul 2019

US Dollar Index technical analysis: DXY flirting with daily lows below the 70.00 mark

- DXY is trading near the daily lows below the 97.00 handle.

- A break below 96.80 support caould lead to more down.

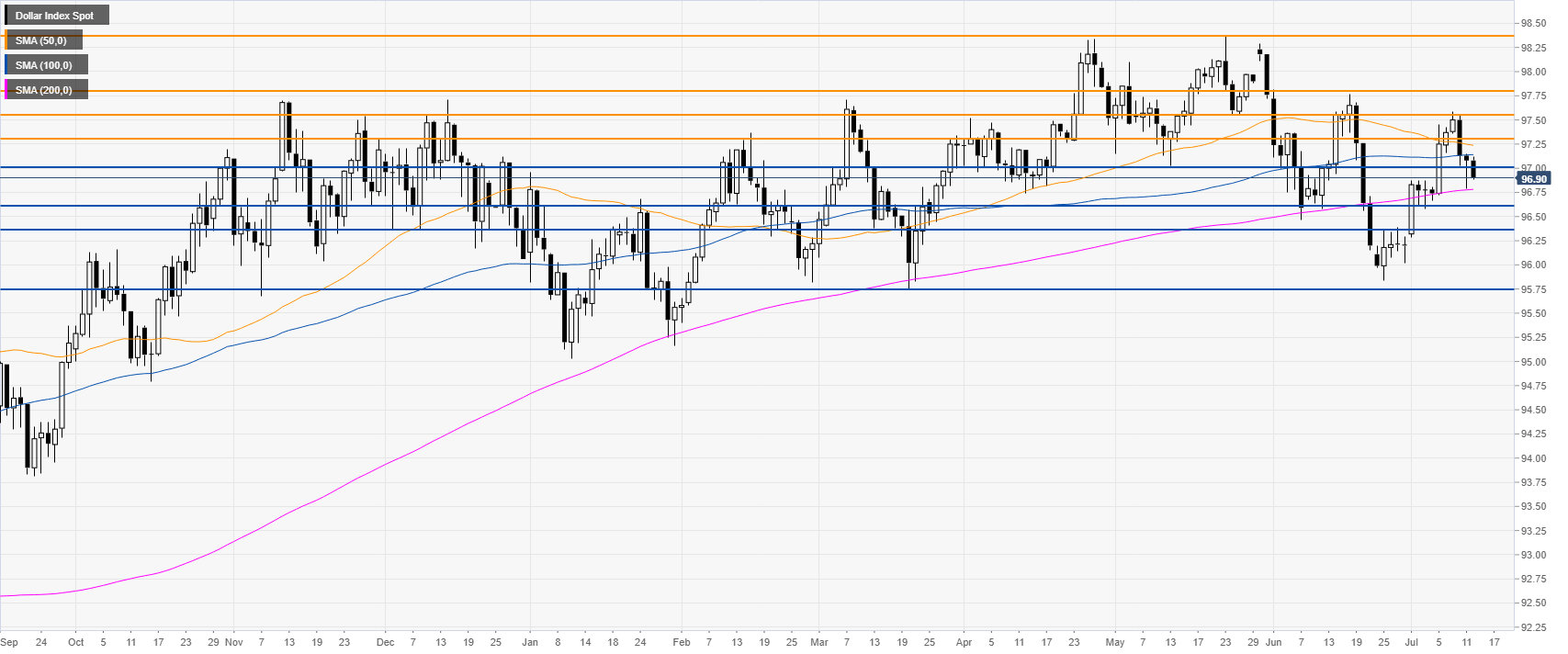

DXY daily chart

The US Dollar Index (DXY) is trading in a bull trend above the 200-day simple moving average (DSMA). DXY is trading at daily lows.

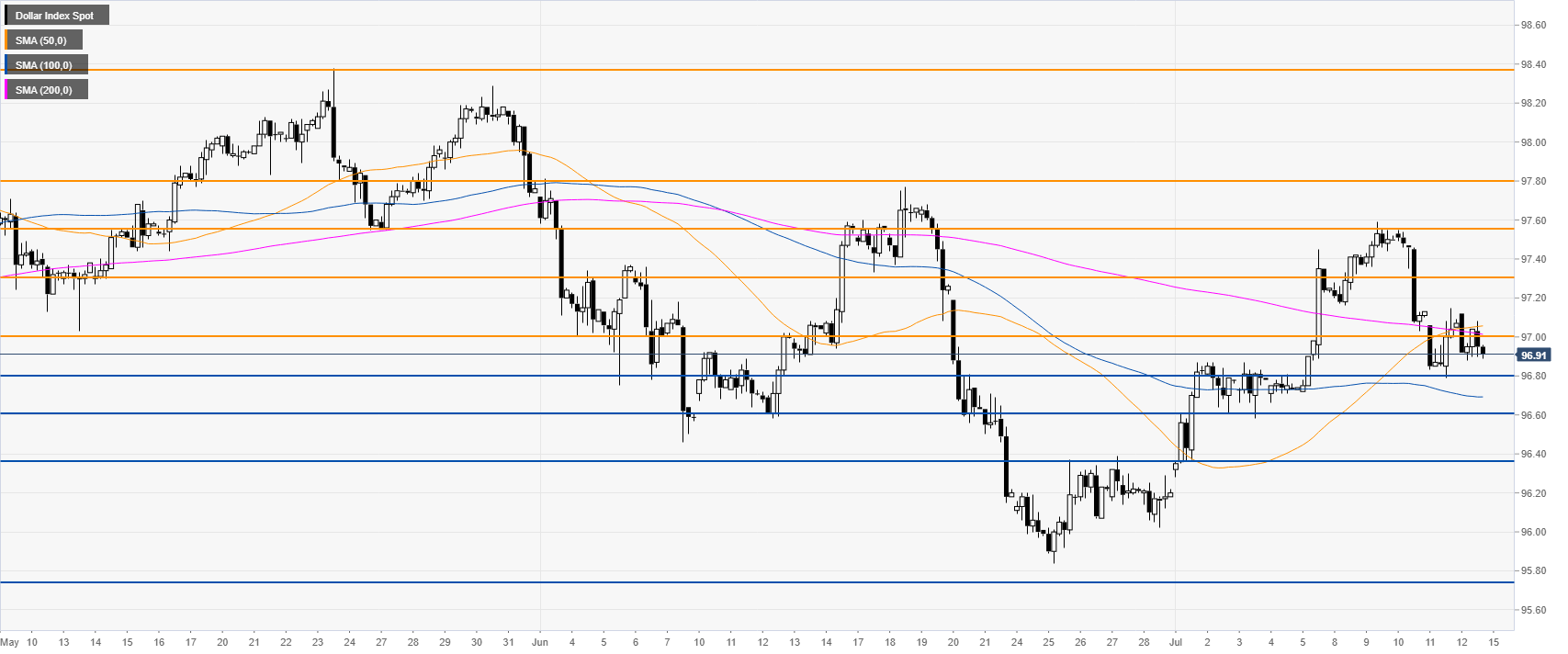

DXY 4-hour chart

The market is under bearish pressure below the 97.00 handle and the 50/200 SMA. A breach below 96.80 could lead to 96.60 and 96.37.

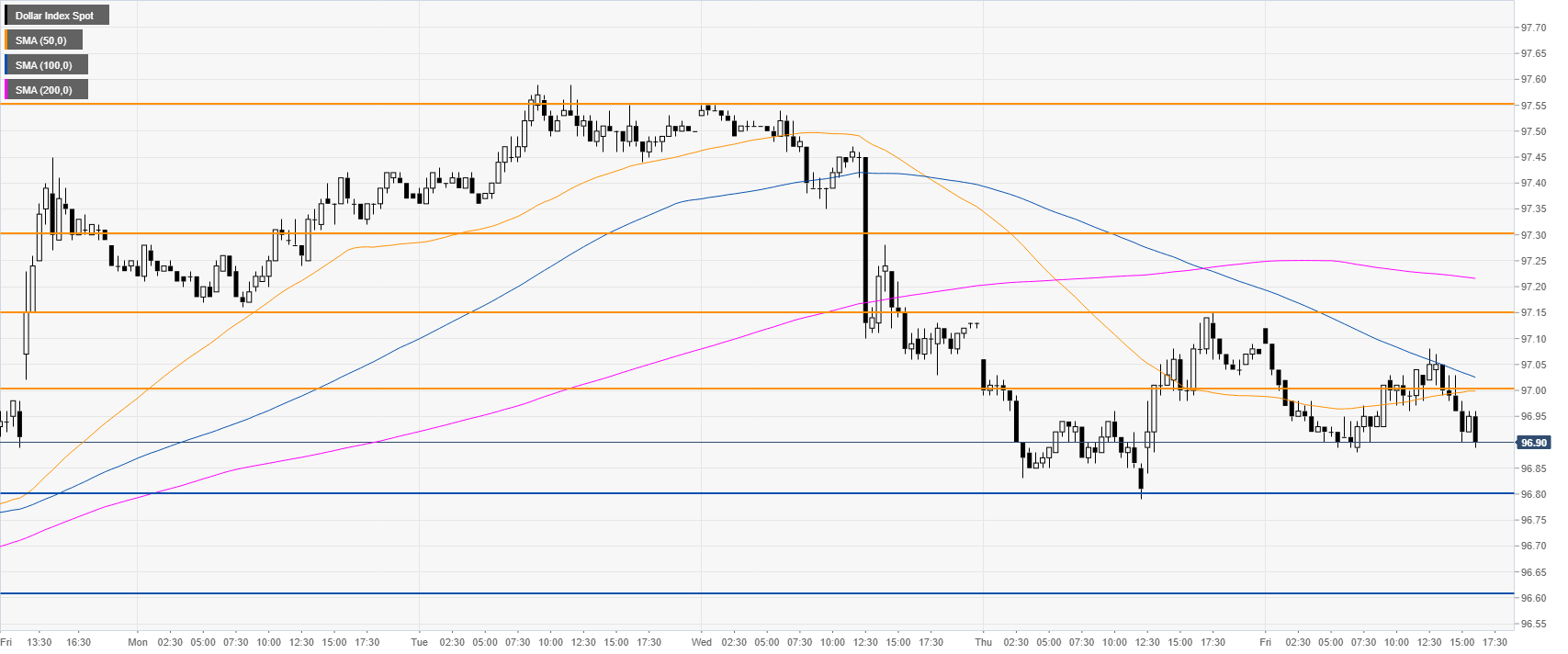

DXY 30-minute chart

DXY is trading below its main SMAs suggesting bearish momentum in the near term. Immediate resistances are seen at 97.00 and 97.15.

Additioinal key levels