Back

22 Oct 2019

EUR/USD technical analysis: Euro on the back foot in the New York session, trading sub-1.1140 level

- The Greenback is picking up some steam this Tuesday, sending EUR/USD to two-day lows.

- Brexit uncertainties are weighing on both the market mood and the Euro.

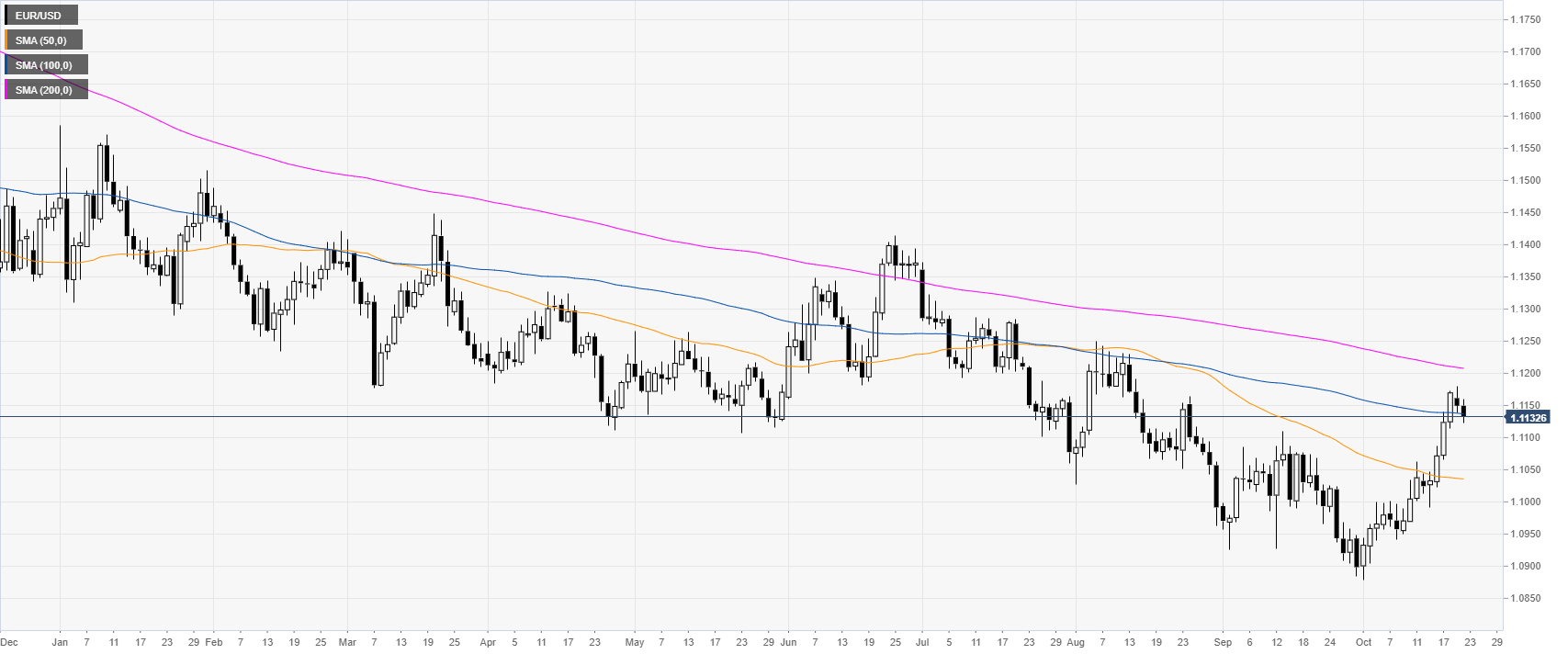

EUR/USD daily chart

On the daily chart, the shared currency is trading in a bear trend below its 200-day simple moving averages (DSMAs). However, the Brexit deal euphoria and the better market mood benefitted the Euro in October.

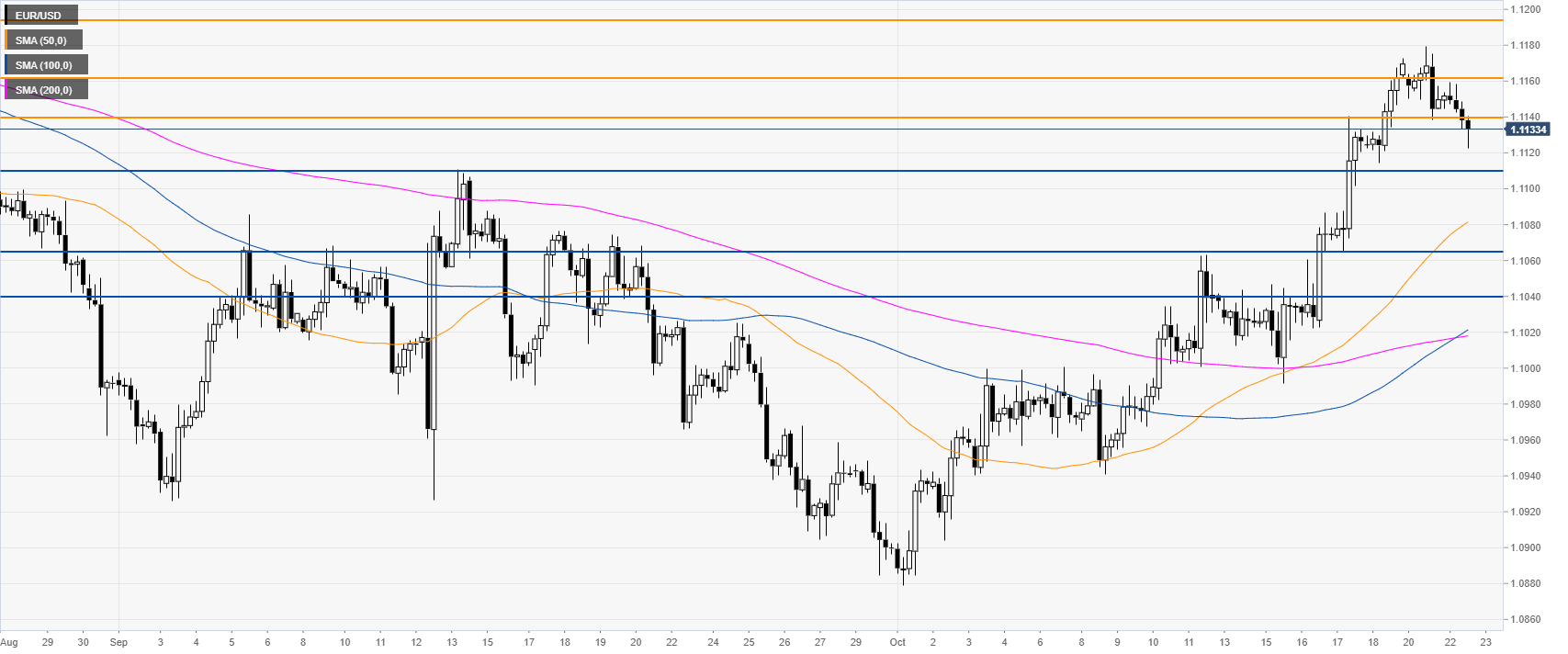

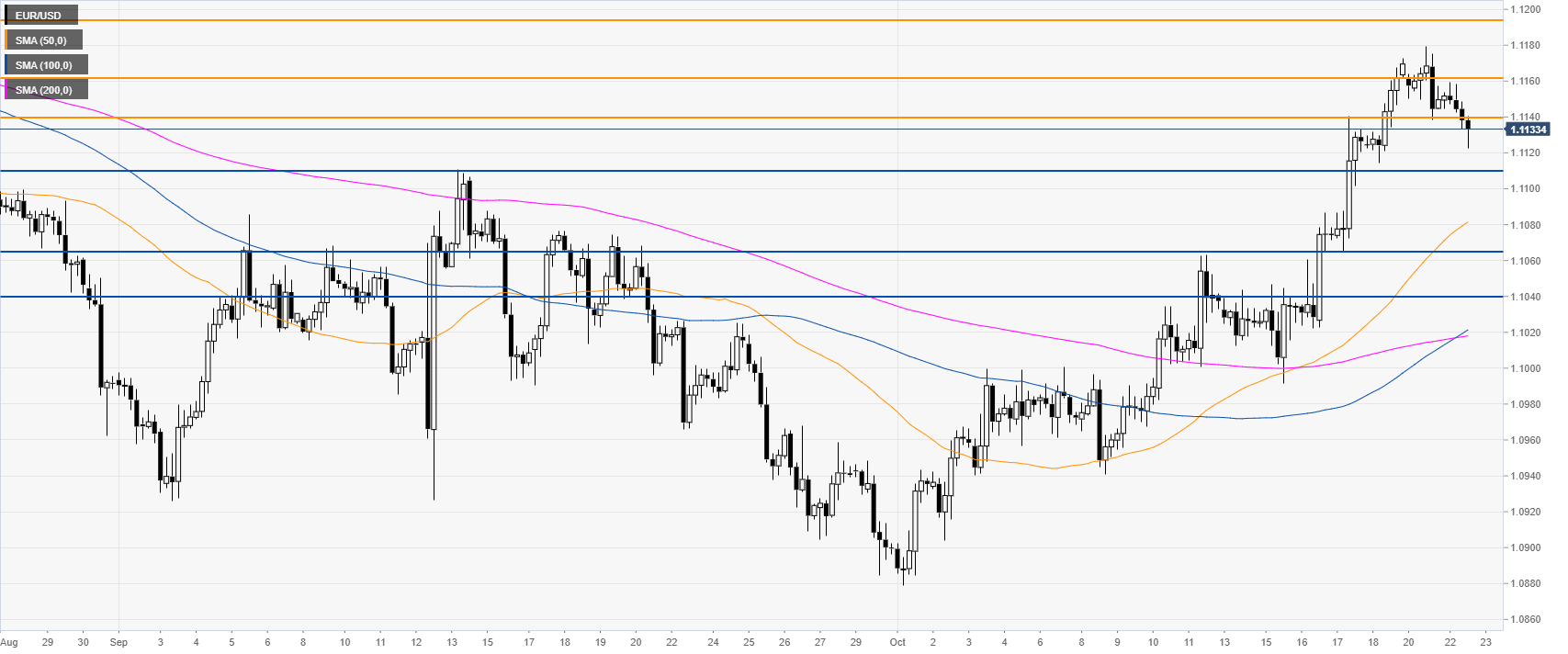

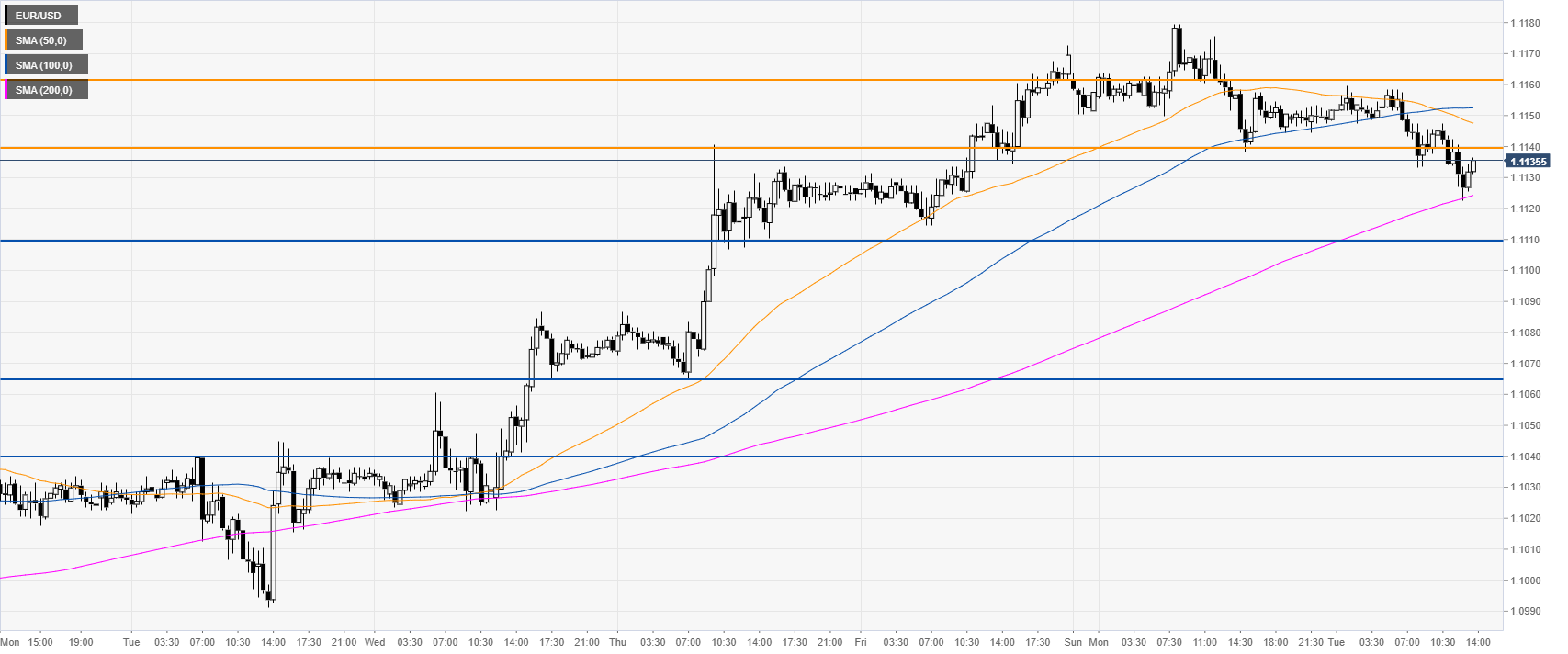

EUR/USD four-hour chart

On the four-hour chart, EUR/USD is starting to ease from the October highs, trading now below the 1.1140 resistance. However, the market is still above its main SMAs, suggesting bullish momentum in the medium term. A break of the 1.1160 resistance can lead to a move up to the 1.1191 resistance, according to the Technical Confluences Indicator.

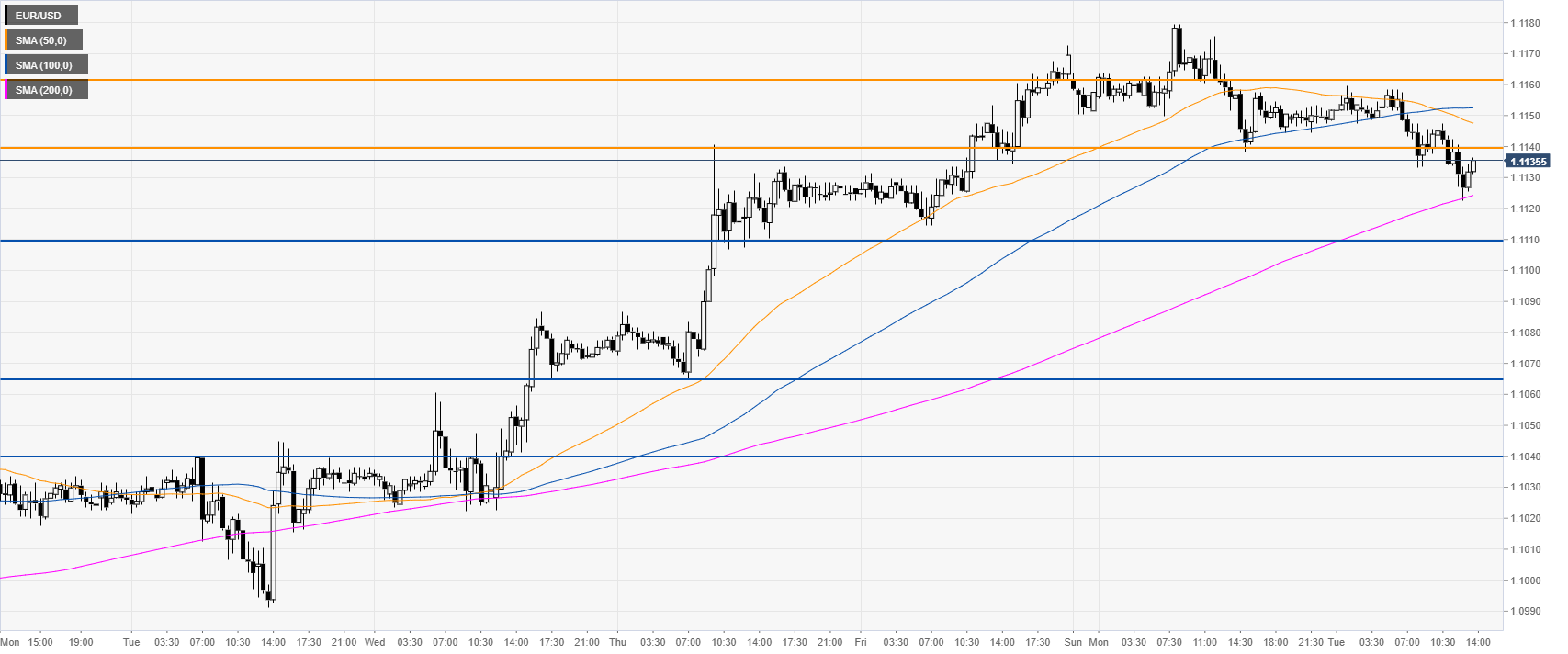

EUR/USD 30-minute chart

EUR/USD is trading below the 50 and 100 SMAs but above the 200 SMA, suggesting a consolidation in the near term. Bears would need to break 1.1110 to reach 1.1065 price level on the way down.

Additional key levels