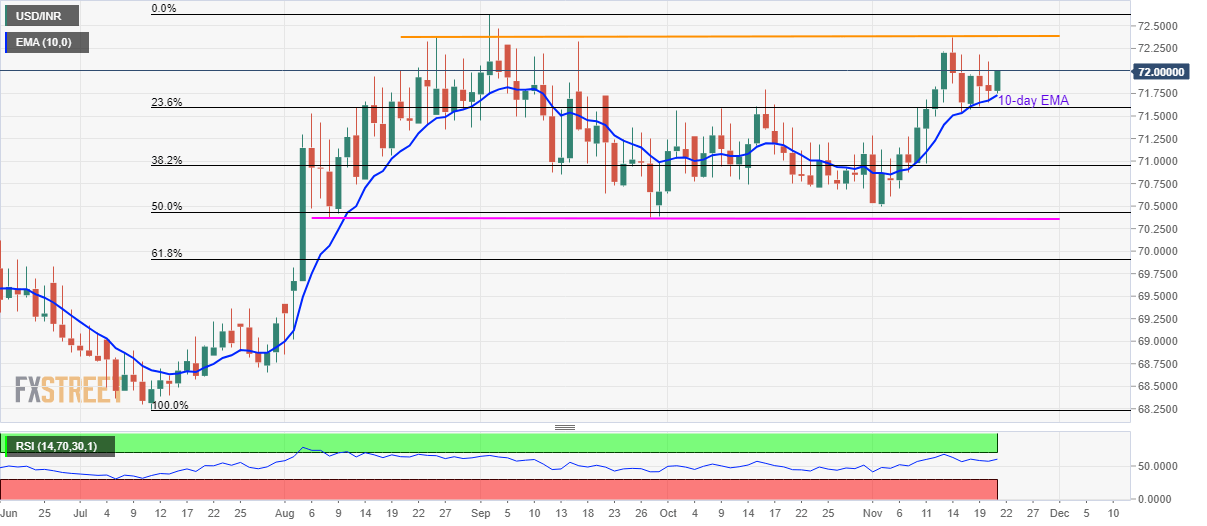

USD/INR Technical Analysis: 10-day EMA keep driving buyers to 72.37/38 supply zone

- USD/INR bounces off 10-day EMA amid bullish RSI conditions.

- Highs marked during late-August, mid-November keep buyers in check.

- Lows flashed during early-August, late-September offer strong downside support.

With it’s yet another U-turn from 10-day EMA, USD/INR takes the bids to 72.00 during Thursday’s Asian session.

The price recovery is also supported by bullish conditions of the 14-day Relative Strength Index (RSI), which in turn favors the quote’s further upside.

In doing so, highs marked during late-August and mid-November, around 72.37/38 will be the key to watch as a break of which could escalate the pair’s run-up to the yearly top close to 72.65 while highlighting December 2018 peak of 72.82 afterward.

Should there be a downside below the 10-day Exponential Moving Average (EMA) level of 71.73, sellers can target 71.50 ahead of aiming November-start top of 71.28.

It’s worth mentioning that the pair’s sustained declines below 71.28 can have 71.00 as a buffer prior to visiting the early-August and September month lows, near 70.37/36.

USD/INR daily chart

Trend: Pullback expected