Back

29 Apr 2020

S&P 500 Price Analysis: US stocks trade in 7-week highs ahead of FOMC

- S&P 500 recovery is gathering up pace ahead of the FOMC this Wednesday.

- The level to beat for bulls is the 2950 resistance.

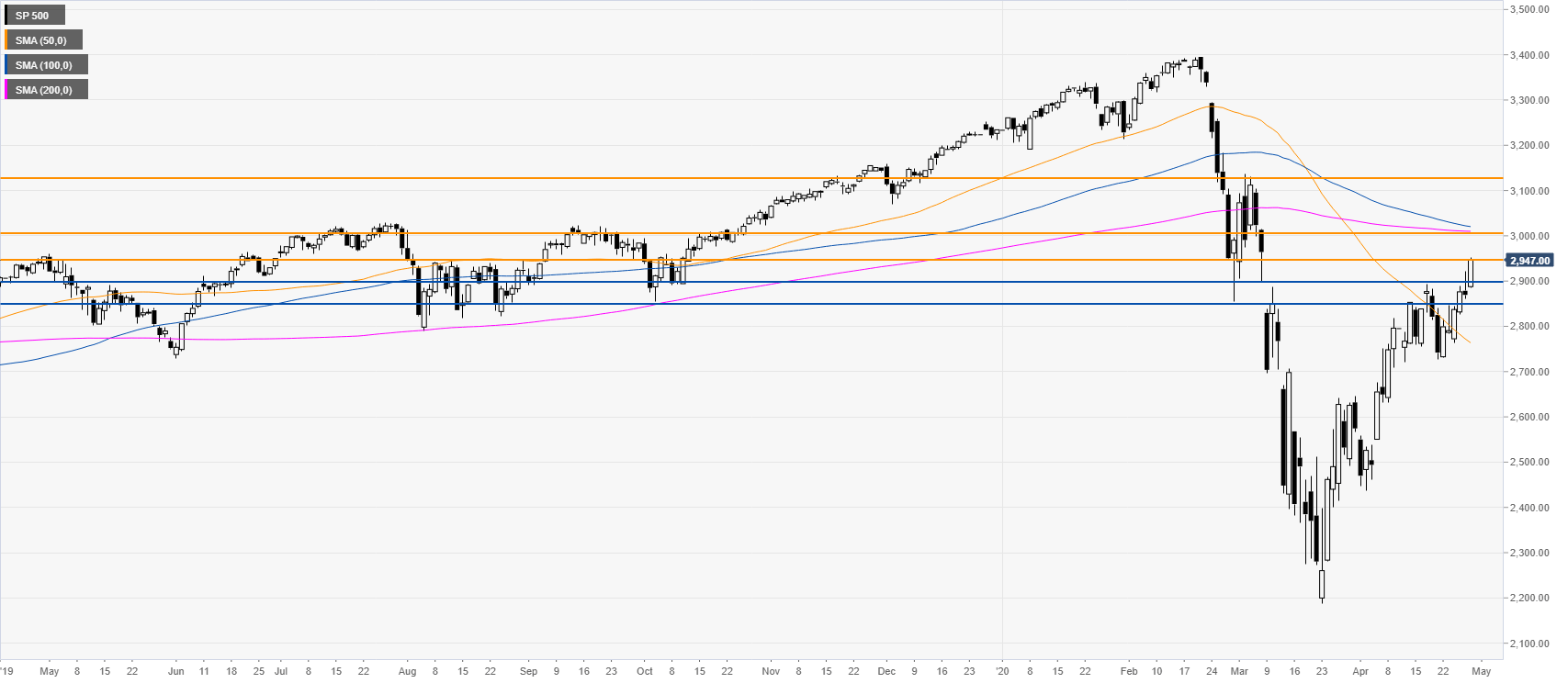

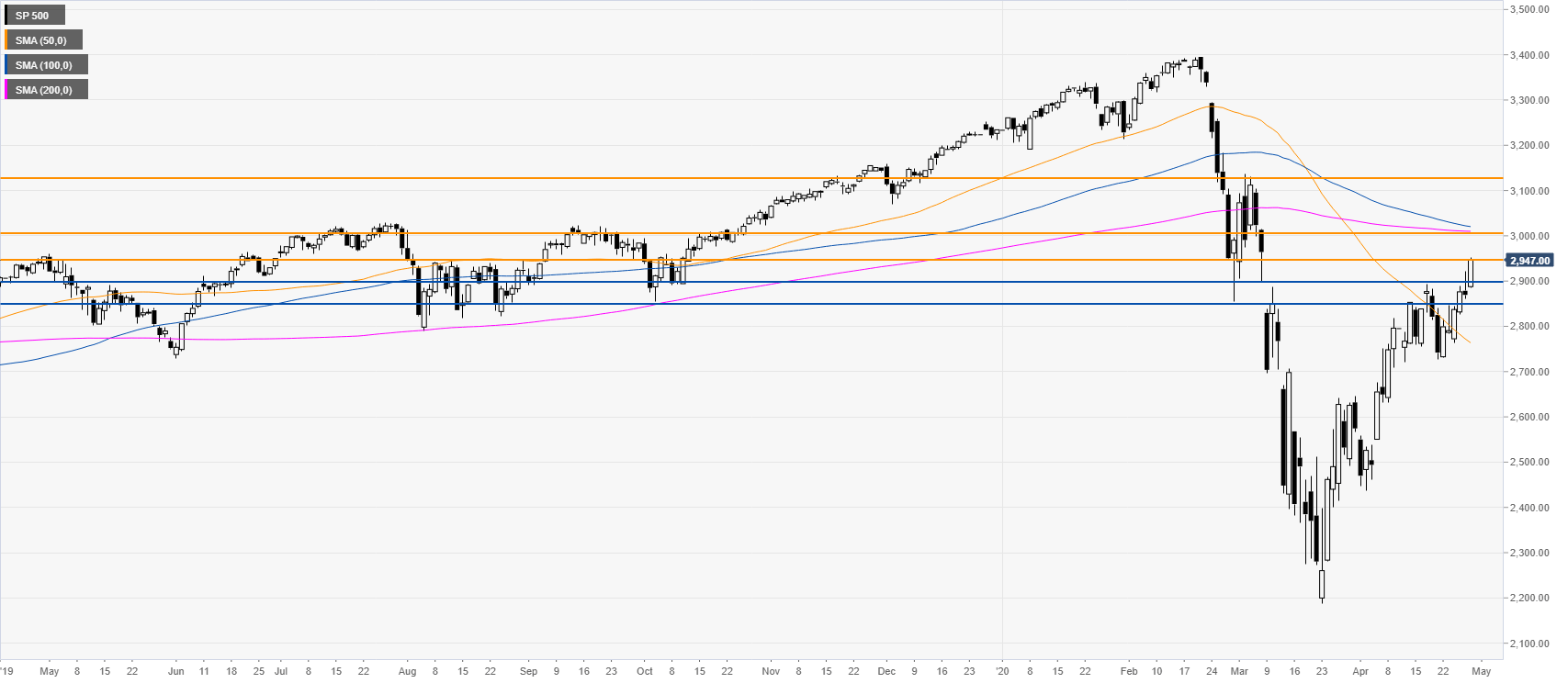

S&P 500 daily chart

The S&P 500 broke above the 2900 resistance on a daily basis opening the gate to more advances towards the 3000 and 3130 levels in the medium-term. In the meantime, the market is challenging the 2950 resistance. Support can be seen near the 2900 and 2850 price levels.

“An optimistic set of projections from the central bank and a hopeful and positive assessment for the US economy from Jerome Powell, especially with a number of states lifting restrictions, will reinforce the equity rally and could begin the end of the dollar panic trade,” according to Joseph Trevisani, FXStreet analyst .

Additional key levels