EUR/USD bulls await a downside extension in the US dollar

- EUR/USD consolidates the highs as the greenback attempts to correct.

- Euro bulls anticipate further weakness in the greenback.

EUR/USD is currently trading at 1.2114 between a range of 1.2095 and 1.2134, virtually flat on the day while the US dollar attempts to stablise in the 90's, DXY.

We have seen a broad-based decline in the greenback. However, the euro has been the third-best performer in the last six months in its own right, supported on improved domestic politics and the central banks resolve to the economic crisis.

''Although the EUR has paid little heed to the EU’s budget issues, a protracted battle would eventually become difficult to ignore,'' analysts at Rabobank explained.

''The ECB is likely to continue calming market conditions by doing whatever it takes to control government bond yields. However, given that the market is positioned long of the single currency, the EUR could eventually become vulnerable if the issue drags on,'' the analysts argued.

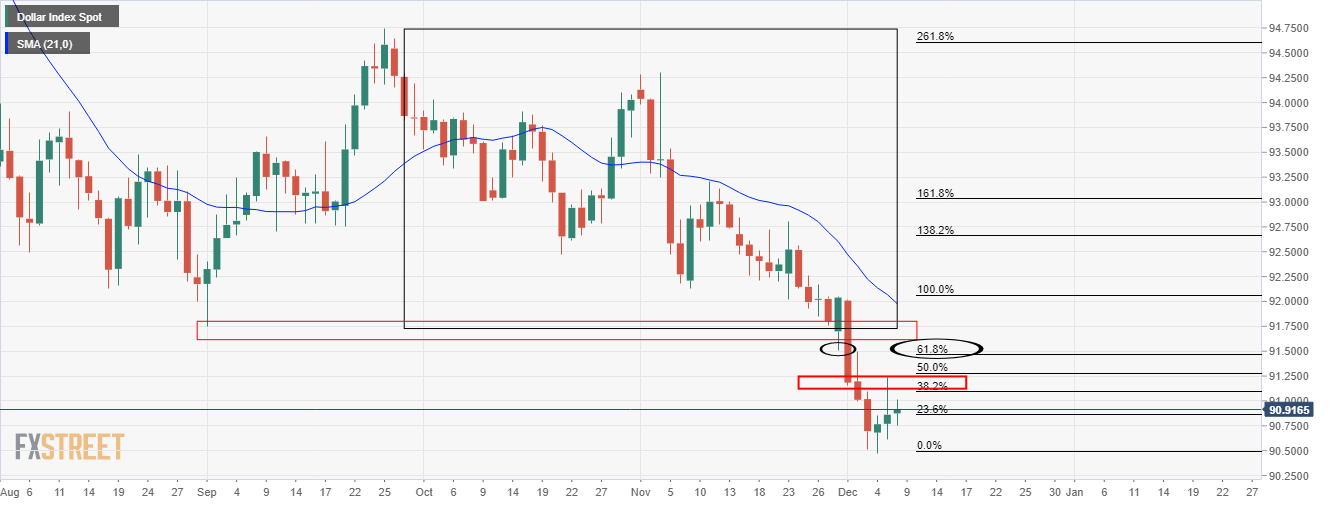

Meanwhile, the greenback is attempting to correct:

Despite the dollar's hefty decline, there is still room to go on a positioning basis when considering net shorts still remain well below that reached in September.

''Despite the positive vaccine news and the perception that the Fed will lean on the yield curve if necessary, it is possible that risk appetite could be kept in check by the realisation that economic data are likely to worsen before they improve,'' the analysts at Rabobank argued, adding:

''More positive news on a US fiscal stimulus bill could boost risk appetite this week.'