AUD/USD Price Analysis: Licks Aussie CPI-led wounds around mid-0.7700s

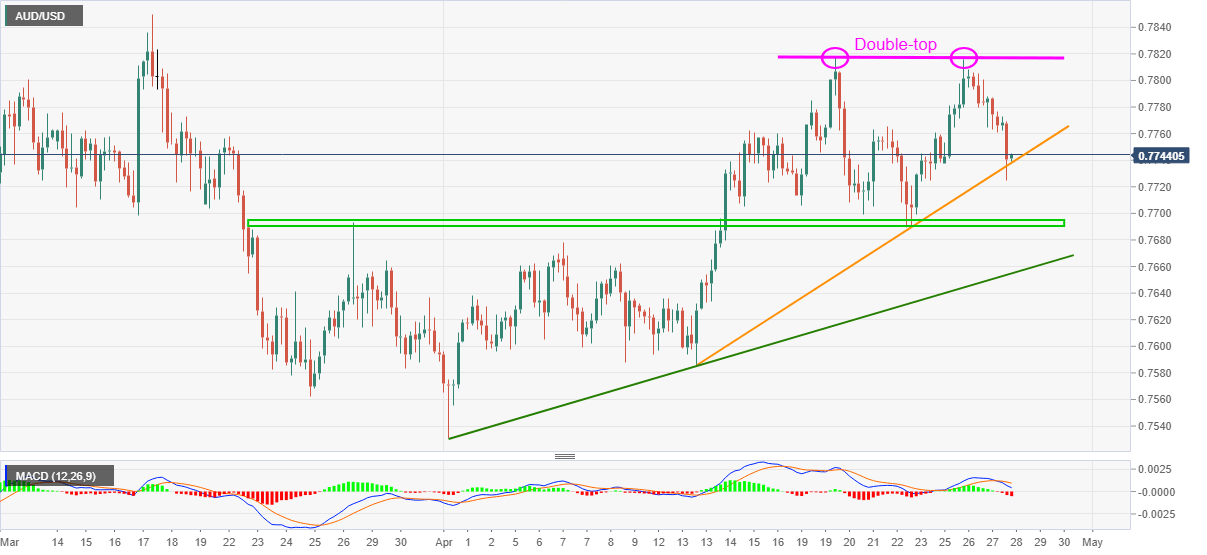

- AUD/USD prints corrective pullback as short-term support line tests bears.

- Sellers look to confirm ‘double-top amid bearish MACD.

- Bulls need fresh monthly high to retake controls.

AUD/USD pares Australia CPI-led losses while printing a bounce-off two-week-old support line, down 0.30% intraday around 0.7742, by the press time ahead of Wednesday’s European session.

Although immediate support tests AUD/USD sellers, bearish MACD and a ‘double-top bearish formation on the four-hour chart signal the pair’s weakness.

As a result, fresh selling should take place below the adjacent support line near 0.7740 to confirm the bearish chart pattern by a downside break of 0.7695–90 area.

While sustained trading below 0.7690 theoretically drags the AUD/USD prices toward the monthly low of 0.7531, an upward sloping trend line from April 01 could offer intermediate challenges to the bears.

Alternatively, recovery moves can target the 0.7800 but 0.7820 becomes the key hurdle to watch afterward.

Should AUD/USD remains firm past-0.7820, March month’s high of 0.7850 will regain the market’s attention.

AUD/USD four-hour chart

Trend: Further weakness expected