US Dollar Price Analysis: DXY to ride EUR/USD's decline

- The value of the greenback is on focus as the euro sets up for a bearish extension.

- DXY is a mirror image and is poised to rally.

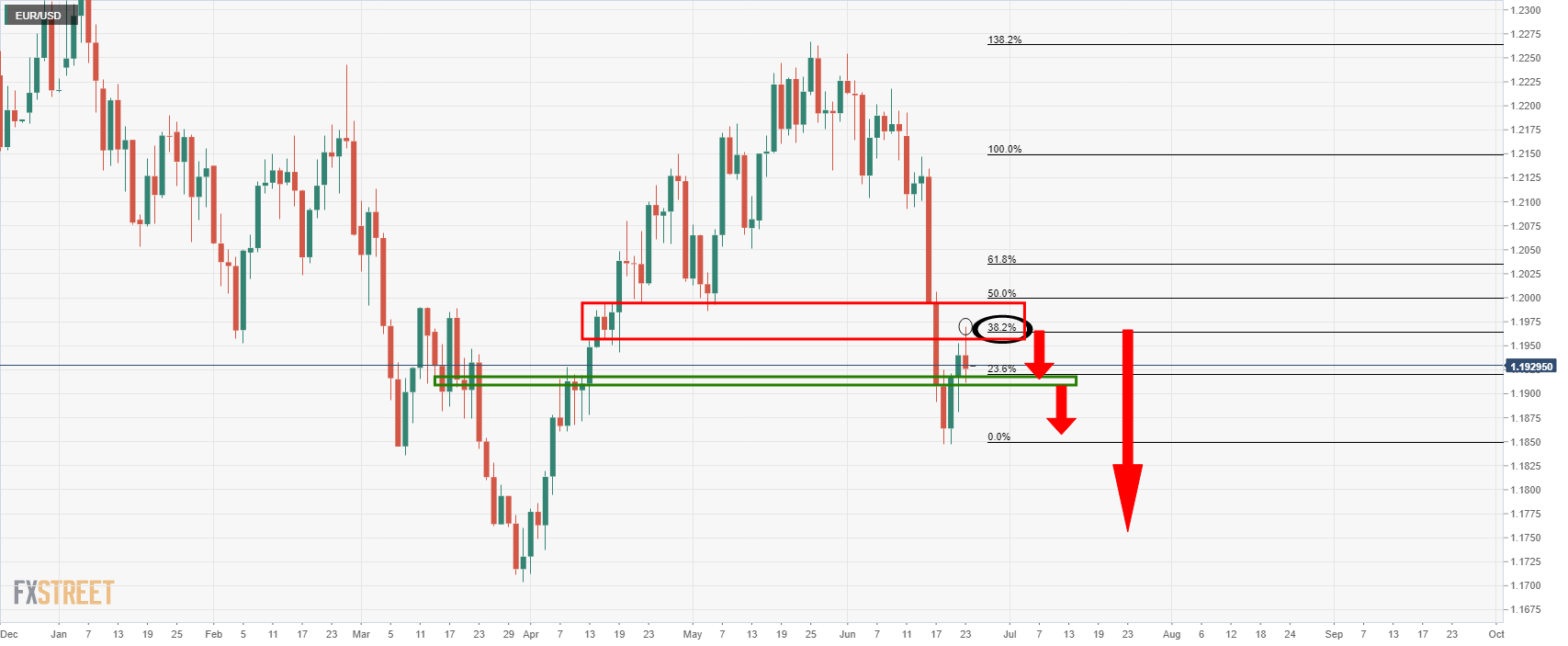

EUR/USD and the DXY both reached their 38.2% Fibonaccis this week where a continuation of the dominant trends would be now expected to eventuate on a break of key structures.

DXY is an index of the value of the United States dollar relative to a basket of foreign currencies, most heavily weighted to the euro by 57.6%.

The Index goes up when the US dollar gains strength when compared to other currencies and is pressured when the euro strengthens.

The following illustrates the bearish bias in EUR/USD and therefore, the reverse in the DXY from a daily perspective.

EUR/USD daily chart

The price is expected to now move in to test the support structure at 1.1911.

1.1920 would be then expected to act as a resistance on a retest prior to an eventual erosion of price towards a test of 1.18 the figure in an extension of the dominant bearish daily trend.

DXY daily chart

DXY will be subsequently pushed to test the resistance of the market's bids in the euro and/or the bearish bets on the greenback at 92.20 that guards 92.50/80 territory and onwards.